An API Marketplace for Insurance Companies

Your newest API might be just what your partners need to streamline their operations, elevate their services, and deliver next-gen products. Through Rapid’s API marketplace, insurance companies can charge for APIs that facilitate claims processing, risk assessment, fraud detection, custom-tailored offers, point-of-sale embedding, and enhanced customer service, as well as compliance and regulatory services to navigate strict, ever-evolving regulations.

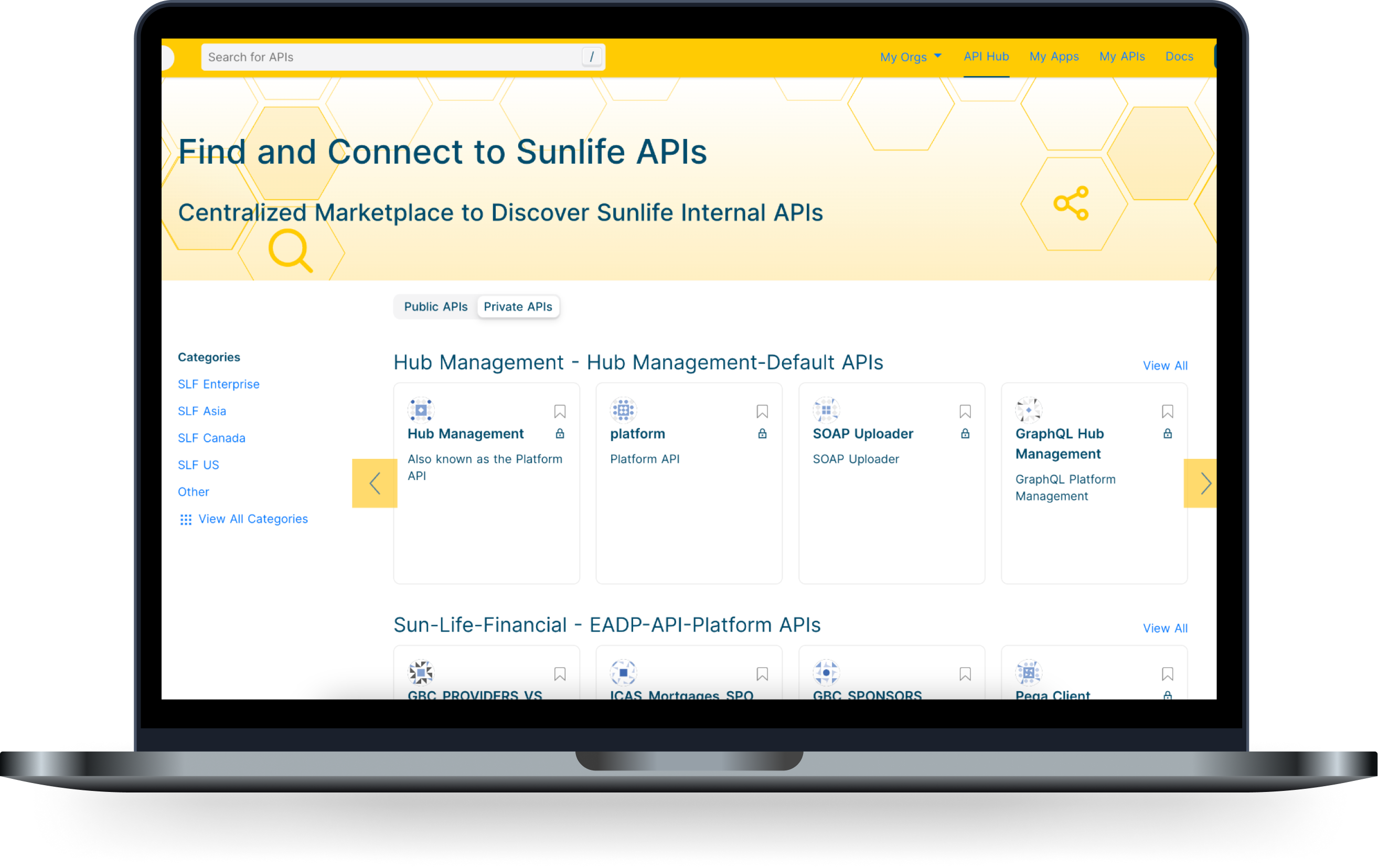

Without a unified platform for building and delivering APIs, Sun Life’s team and partners struggled to collaborate effectively and efficiently.

Rapid’s marketplace connected all lines of business across Sun Life’s entire API ecosystem, facilitating:

Smoother collaboration for 40K+ employees and 600+ partners

Dramatic cost reductions

New revenue generation

Integrates seamlessly with internal systems

Supports all of the provider’s APIs

Works with any API gateway or management system

Deploys across multi-cloud environments

Provides a dedicated dashboard for managing APIs and ensuring data security,compliance, and adherence to SLAs