An API Hub Tailor Made for Banking and Financial Services

Rapid’s API Hub for Enterprise Helps Unlock Innovation in Banking and Financial Services

APIs are a key component of modernization efforts in the banking sector, fueling a far-reaching change in technology, business strategy, and even financial regulation. APIs have become key to creating innovative services, providing access to data, and opening up new channels.

To realize the full potential of APIs, financial institutions need an API strategy that works from the inside out using internal APIs, leverages an enterprise-class API Hub, provides a flexible deployment model, offers developers a friendly user experience, and becomes the cornerstone for future innovation.

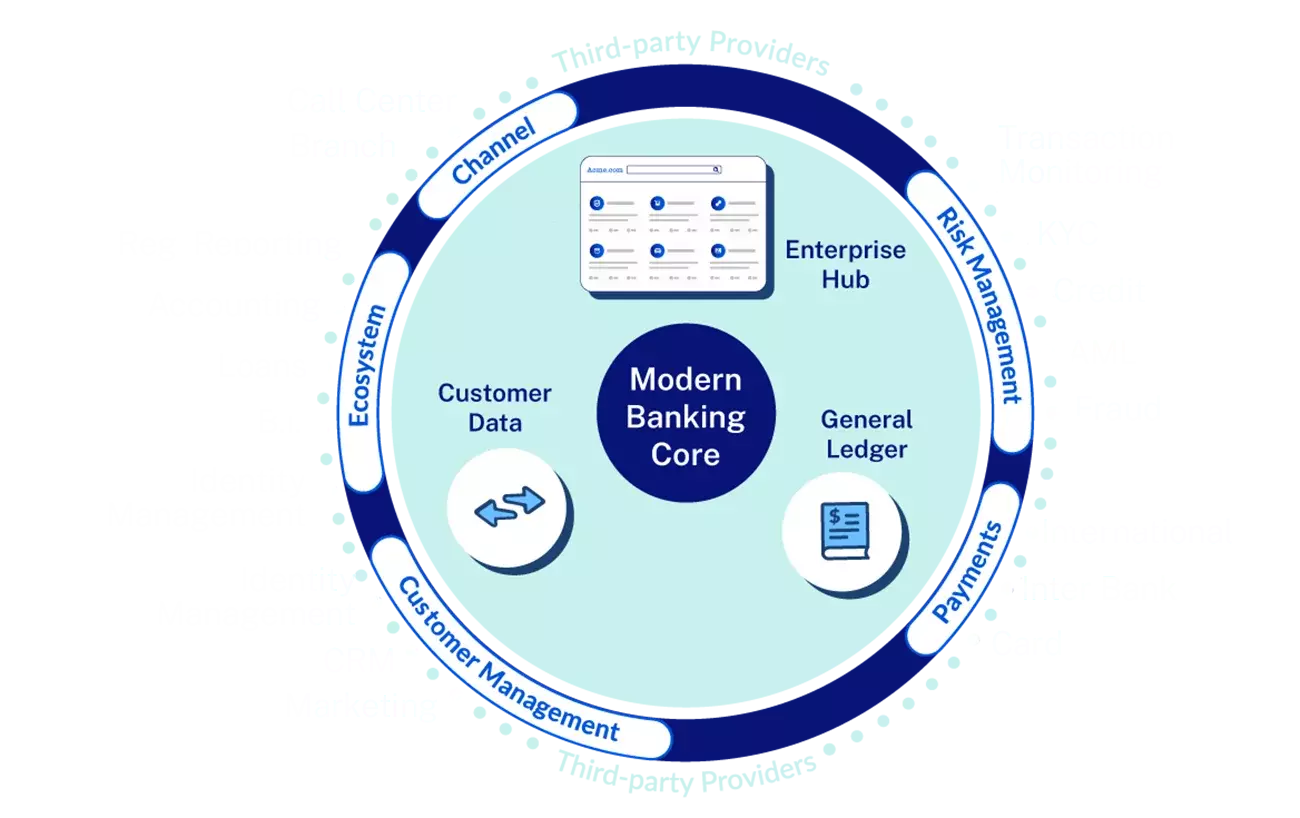

Today's Modern Banking Infrastructure

Although many banks and financial services firms participate in the API economy, the torrid pace in which new APIs are created has led many institutions to think more broadly about their API strategy and infrastructure. As more third-party APIs are developed, firms need to take the steps to develop the right API strategy:

- Work inside out: Start with internal APIs to build up API muscle.

- Utilize an API Hub: Ensure you have the right tooling and infrastructure in place.

- Create flexibility in deployments: Start thinking about APIs earlier in the software development lifecycle.

- Build with the developer in mind: Create an experience that is easy and intuitive to ensure adoption.

- Make room for Innovation: Leverage your APIs to offer new products and services for partners and customers.

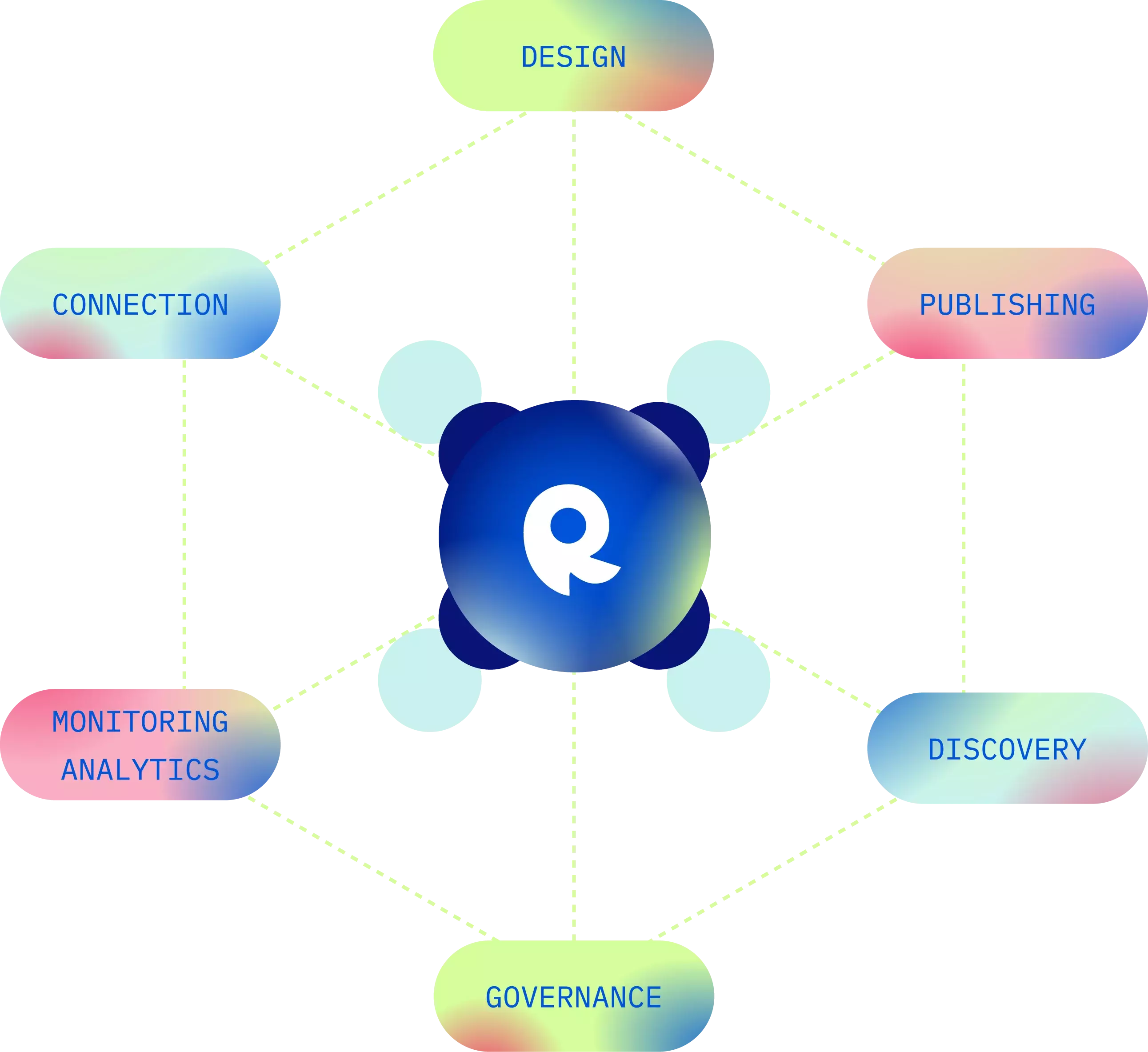

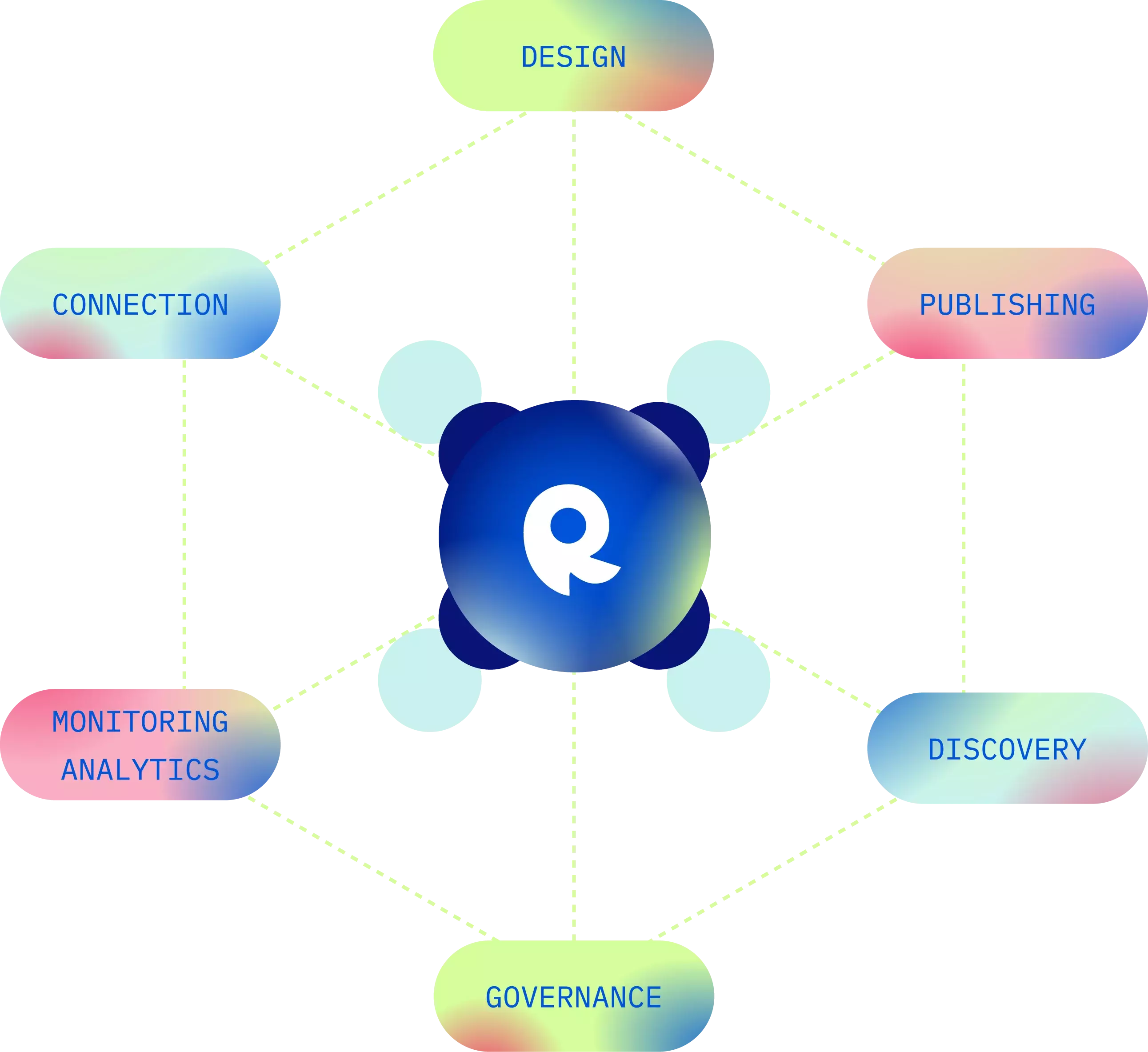

API Hub for Enterprise

API Hub for Enterprise addresses the needs of modern-day APIs. API Hub for Enterprise is a white-labeled, internal API Marketplace used by developers, analysts, and product managers to discover and connect to internal APIs, as well as external API subscriptions. Additionally, companies can use the same API Hub for Enterprise to collaborate with partners.

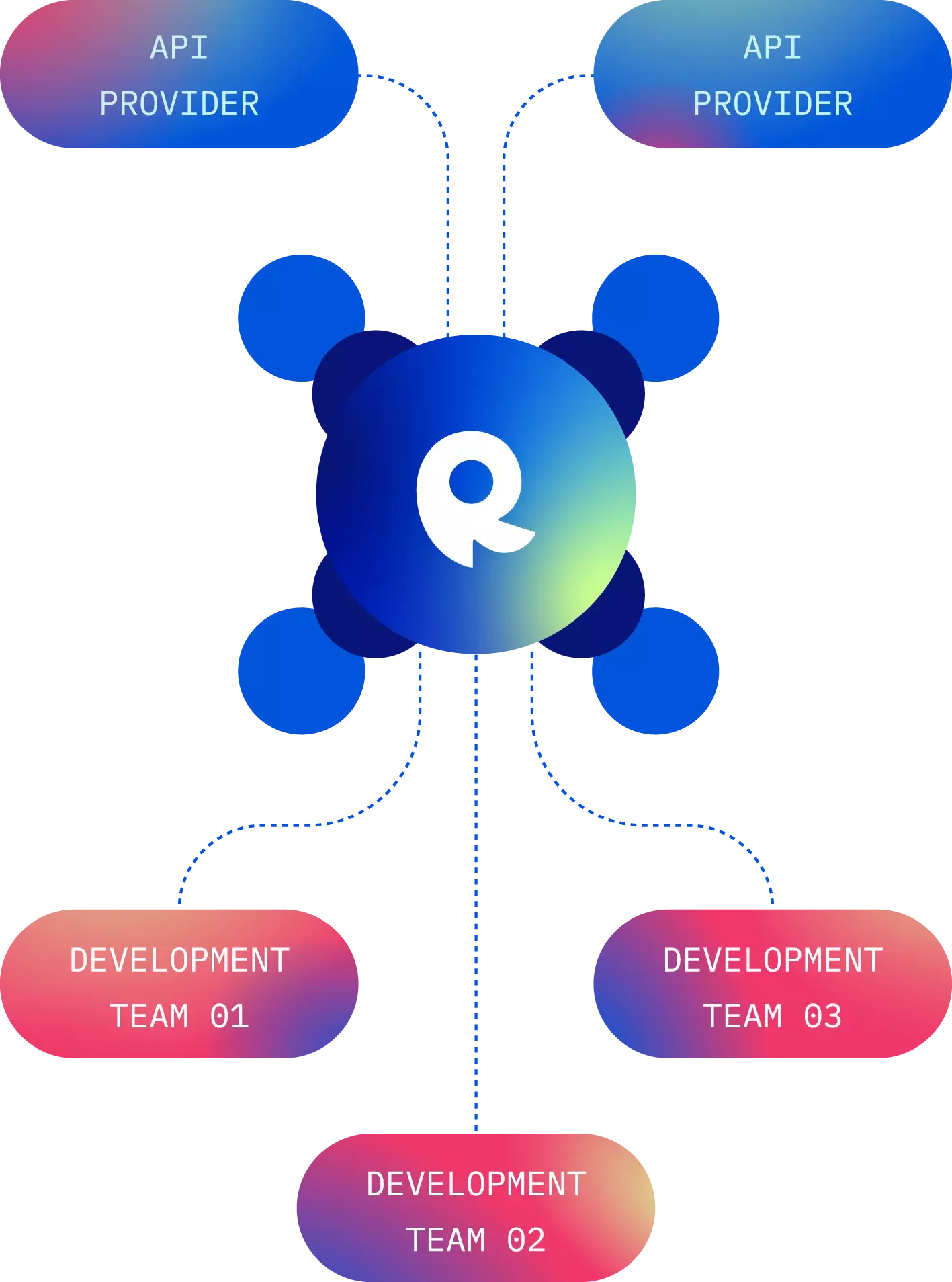

Use Case: API Hub for Enterprise for Internal

As companies grow and split into multiple teams, they form “software silos” with each group responsible for a specific product or technology. With limited visibility into what each team is working on, the result is often code duplication, longer development cycles, and a lack of overall governance.

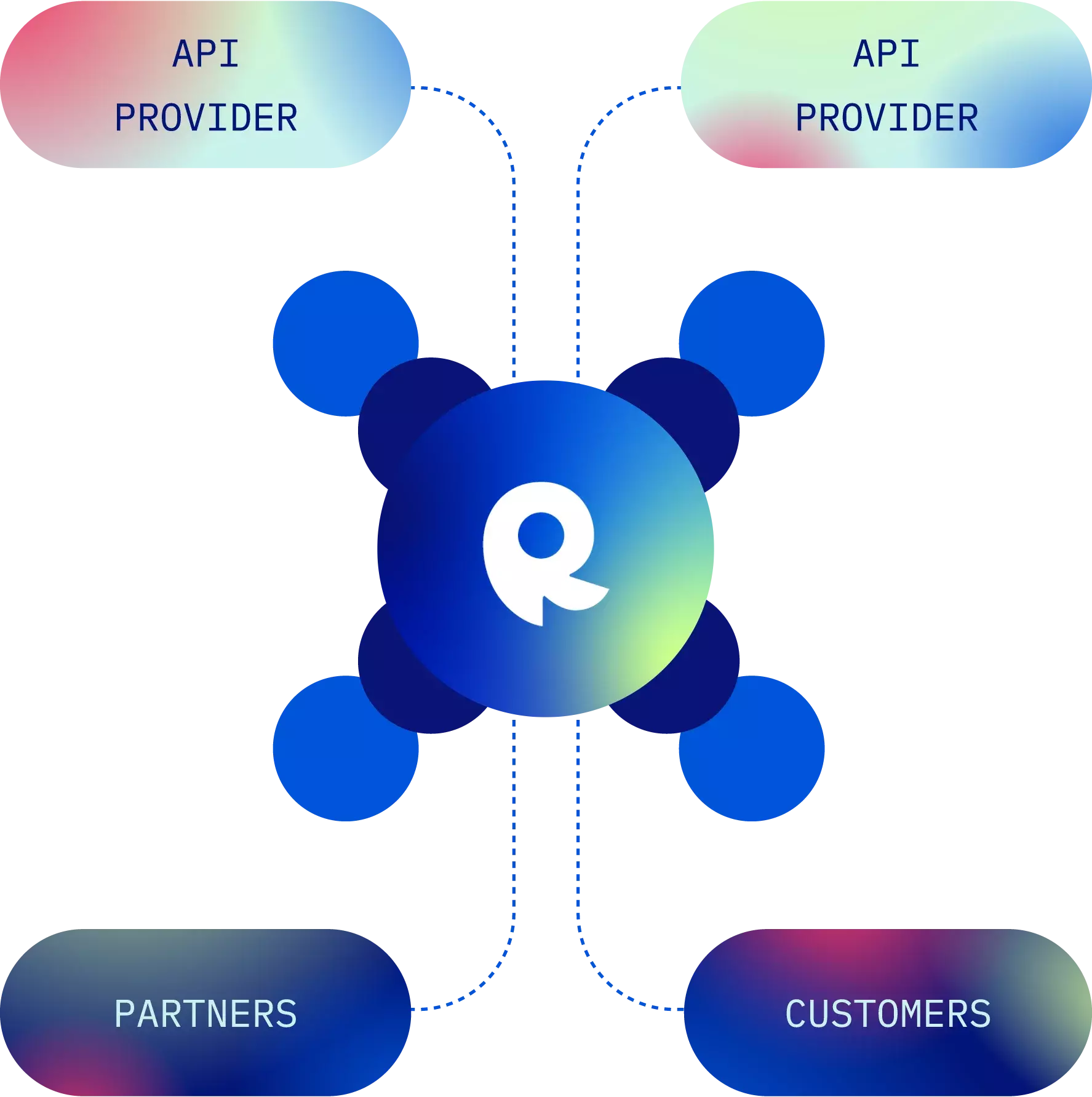

Use Case: API Hub for Enterprise for Partners

Companies can offer partners and customers access to key APIs using API Hub for Enterprise as a customer and/or partner API hub. Through the branded API hub, your organization can collaborate with other companies to create unique solutions and new monetization channels. In some cases, you will be able to reduce development cycles, creating stickiness to applications and services.